Toronto Income Property Newsletter – July 2013

Happy belated Canada Day. I hoped you all enjoyed this past long weekend. There was a lot to do in town this weekend from Pride, to the Chin picnic, Ribfest, and of course, the Blue Jays and TFC. Let’s hope for a stellar summer from both of our “boys of summer” teams.

We’re at the midway point of 2013 and the Toronto real estate market continues to still be very much a Sellers’ market. Quality income properties are still in high demand as there has been a noticeable decline in inventory and all the best ones still seem to attract multiple offers. Naturally, July and August tend to slow down even more. This month I will be commenting on the income property activity in and around the GTA over the past six months.

Enjoy your summer everyone!

*

Since we are half way through the year I’d like to present my income property statistics for the first six months of 2013. This data is all pulled from MLS and includes all properties that have sold with two or more kitchens, thus being deemed to have some sort of rentability (thereby income-generating component.) Here are some selected Toronto neighbourhoods – see how your area is doing compared to other parts of the city.

Toronto Downtown (C01)

# of trades: 22

Average Sale Price: $815,485

Annex (C02)

# of trades: 23

Average Sale Price: $1,305,984

Cabbagetown (C08)

# of trades: 7

Average Sale Price: $916,413

Rosedale (C09)

# of trades: 7

Average Sale Price: $1,632,521

Riverdale (E01)

# of trades: 36

Average Sale Price: $662,173

Beaches (E02)

# of trades: 18

Average Sale Price: $824,594

High Park (W01)

# of trades: 30

Average Sale Price: $922,364

Bloor West Village (W02)

# of trades: 20

Average Sale Price: $864,216

*

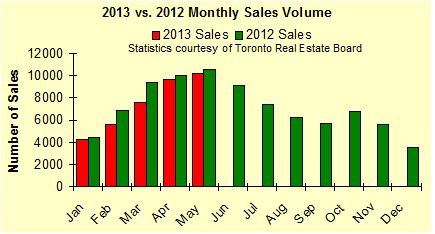

Here’s what has been happening with the Toronto real estate market overall so far this year: Note how 2013 sales are less than 2012. This is indicative of fewer houses being put up for sale. Expect the numbers for June, July and August to continue this trend.

Here’s what has been happening with the Toronto real estate market overall so far this year: Note how 2013 sales are less than 2012. This is indicative of fewer houses being put up for sale. Expect the numbers for June, July and August to continue this trend.

*

The City of Toronto is currently undertaking a review of its development charges. These fees are effectively set to double on all construction projects.

Development charges are fees collected from developers at the time a building permit is issued. The fees help pay for the cost of infrastructure required to provide municipal services to new development, such as roads, transit, water and sewer infrastructure, community centres and fire and police facilities. Most municipalities in Ontario use development charges to ensure that the cost of providing infrastructure to service new development is not borne by existing residents and businesses in the form of higher property taxes.

Toronto has the lowest development charges in the Greater Toronto Area, with most municipalities demanding rates double that of the city. Even so, Toronto made about $150-million from development charges in 2012.

There has been a lot of cash generated by the condo boom in this city. I wonder if this increase might be a little late given that the majority of building sites have been picked over and the condo market now seems to be slowing up a little.