Toronto Income Property Newsletter: Fall 2024

As the summer comes to a close many of us active in Toronto real estate are looking forward to what the next few months will bring. Summer is traditionally a little slower and the market often starts to pick up again after Labour Day. Then we have the three-month run up to Christmas. In the next few weeks, more properties will hit the MLS, and we’ll get a better sense of how pricing and strong the market will be for Sellers. We have had three recent interest rate drops and more are anticipated so that will likely dictate the direction in which things are headed.

There haven’t been too many income properties for sale this summer across the entire downtown core. I cover east, central and west neighbourhoods quite extensively and certainly could have used more quality inventory. Prices have fallen a little on duplexes, triplexes and multiplexes since the higher interest rates have negatively impacted affordability. As the rates decrease, we should see more income property buyers enter the market.

The concern for investors has moved from cap rates (four plus is quite common once again) to monthly affordability. With higher monthly finance payments, the break-even points have risen. In order to break even or cash flow positive, one would have to put down a sizable deposit, often as much as 40 to 50 per cent. This becomes quite prohibitive for many. It just isn’t feasible for everyone to pay a deposit of upwards of a million dollars to make the numbers work.

Since the market has changed, I have been re-educating my clients on the best way to proceed with their investment property purchases. Toronto real estate is still a very good bet long term – you just need to proceed with caution and get qualified assistance. If you or someone you know is looking for advice on how to fiscally navigate the Toronto real estate market, please don’t hesitate to reach out.

I wish everyone a very productive fall season; a great holiday and I look forward to being back here with you in the new year.

– P.A.

Interest Rates Slowly Starting to Drop

Third straight rate drop signifies a brighter future for buyers & sellers of income properties.

Form N12 Explained

The importance of serving your tenants notice the right way with the right forms.

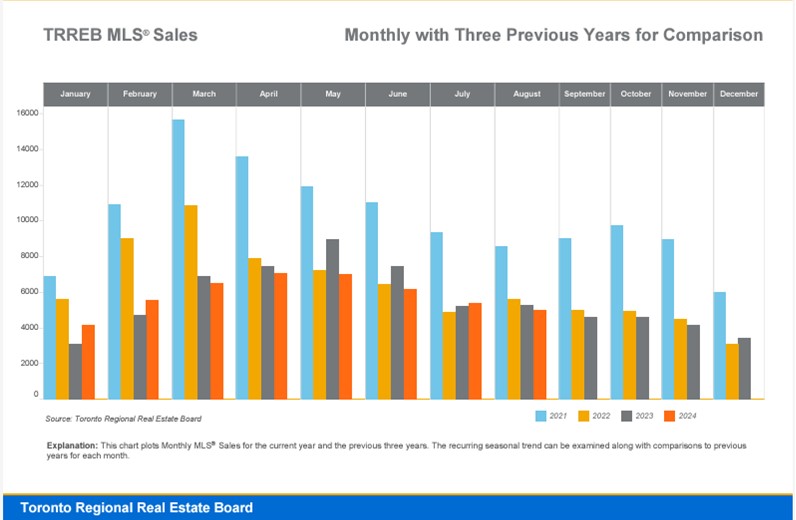

Toronto Real Estate Statistics

YTD sales have been relatively consistent over the past two years.