Toronto Income Property Newsletter – August 2010

I hope everyone is enjoying this very warm summer. Congratulations to Spain on winning their first World Cup. I hope all of you soccer fans enjoyed the tournament. Now we can turn our attention to TFC and their quest for a first-time playoff birth. With the dismal performance of the Maple Leafs, Raptors & Blue Jays over the past years, this town needs a winner. Hopefully our boys in red will get it done!

*

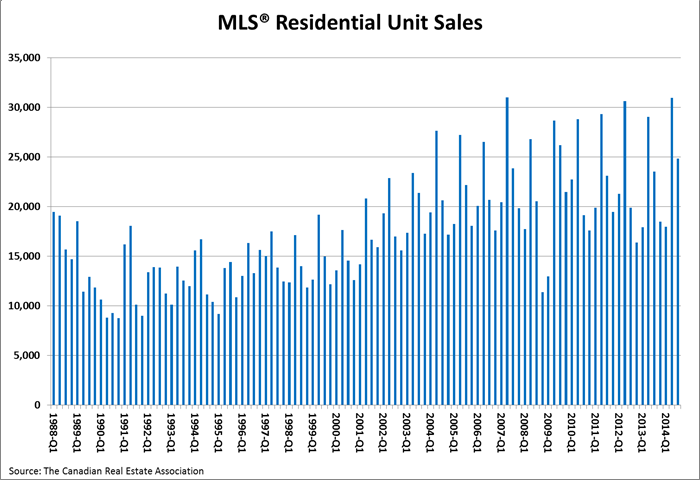

For the first time this year, June sales fell below 2009 numbers. This isn’t surprising given the spike that happened last year leading into the very robust fall sellers’ market. The Toronto Real Estate Board reported 8,442 sales of single family homes in June 2010. This sales volume represents an 11 percent decline from the sales volume for May 2010 as well as a 23 percent decline from the sales volume reported for June 2009. Declining sales volumes at this time of year are not unusual as they typically signal the end of the spring market and the onset of the summer slowdown. Some are saying that this slowdown will continue into September and prices may start to drop. I don’t think this will be the case at all. While I don’t expect the same number of trades as last year, I don’t think there will be any significant price decreases. At the moment, we are suffering a quality inventory shortage so I will be surprised if when more houses come up for sale, the prices don’t stay in line.

*

At Plex Realty, as many of you are aware, we are very active with duplexes, triplexes and multiplexes as well as “fixer-uppers” that may have profit potential. One other area that I have also done a lot of business in the past is with mixed-use buildings – retail storefronts with two or three apartments and/or offices above.

Most of these properties are on popular retail strips like Queen, Bloor, College and obviously Yonge St. There are also little strips like the Forest Hill Village, the shops on Bayview south of Eglinton or at the top of Coxwell in Leslieville. Many neighbourhoods have retail strips that offer every good and service imaginable. Some areas are more known for specialties – for instance restaurants on the Danforth, or on College in Little Italy. Most of the time these buildings fall under the I.C.I. umbrella (commercial rather than residential) even though there may be residential rental apartments above the main floor retail space.

These properties can be quite a decent for someone looking to live-in or for the absentee investor. These mixed-use buildings have been similar to strictly residential properties over the past few years insofar as lower bottom-line returns and lesser cap rates. My advice is to make sure that if you buy a mixed-use building that your main floor retail tenant is on a long lease and that their business is strong, unless of course you have a business to operate out of the main floor yourself. Most of the properties derive the bulk of their income form the main floor lease and it would be difficult to immediately make up that rent if your anchor tenant splits. It is much easier to find a residential tenant than a commercial one. Remember too that every user is going to want to build to suit, so that cost is likely cost you months of free rent. Also, most of these properties are on busy main streets, so keep that in mind if you intend to live in it.

Some of my clients have recently asked where the commercial market is going since each month my comments seem to be more focused on the residential resale side of the equation. Unlike houses in the prime areas of the core, I think that the prices of commercial properties and specific mixed-use retail storefronts may start to come down a little. It is believed that REITs (real estate investment trusts) are great indicators of where the commercial market is going. Experts say that the overall commercial prices have already started to drop and there may be a further decline to follow. This is quite interesting because there is no indication that this price “correction” is happening yet on the residential side.

Does that mean that a storefront with two units above it will be a better buy this year than a regular triplex? Quite often I will highlight duplexes or triplexes that trade for over-asking and comment on how the investment value gets thrown out the window. I think that the bottom line is if a mixed-use building is throwing off better numbers than a completely residential multiplex and has good lease(s) in place, then it should be considered seriously. I prefer all residential income properties just from a rentability point of view but remember that investment real estate is all about the returns. If cap rates start to get noticeably stronger on mixed-use buildings, I will start steering more of my clients in that direction. It hasn’t happened yet, but as I pointed out earlier, it may. So if you if you’ve been thinking about opening another up-scale coffee bar in your neighbourhood in your own building, then the time may be right.

*

(Q) There is a Used Car Salesman, a Realtor and a Lawyer. And you have a gun with two bullets… Which should you shoot?

(A) You should shoot the realtor twice… Just to be sure.