Toronto Income Property Newsletter: February 2015

I’m very happy to announce that my new e-book “The Toronto Income Property Guide” is now available. You can download it for free here. It is a substantial update to my first real estate book “Live for Free” which I wrote many years ago. My book is currently available on your mobile through Kindle and other leading e-book sites. I have added a whole new section on landlord tips and strategies as well as many other valuable tidbits of knowledge that I have observed along the way. It is intended to be an A to Z guide on everything you need to know to be successful in the income property market. Please check it out and pass along the link to anyone you know who may be interested in real estate investing in Toronto.

We have also just updated the Plex website so kindly take a moment to have a look at the redesign. I always welcome your comments and feedback.

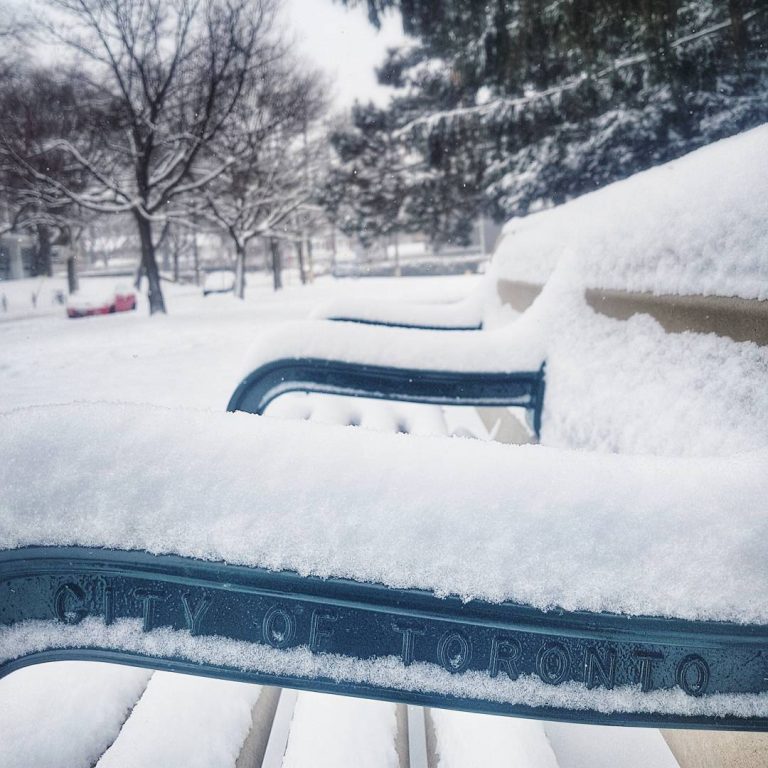

Despite some really cold days in January, the market got rolling again pretty much where we left off last November. I expect multiple offers on most of the new inventory that has hit over these past few days. The Bank of Canada have lowered interest rates yet again. Toronto is still going to be very much a Sellers’ market for the foreseeable future.

Stay warm everybody. Go Raptors and Happy Valentine’s Day!

-P.A.

The following articles are excerpts from my newly released “The Toronto Income Property Guide”:

Legal vs. Non-Legal Rental Suites & Fire Retrofit

One of the most common concerns that I experience in the field is the question of legal vs. non-legal apartments in residential income properties. The issue usually pertains to basement apartments in duplexes but it also comes into play when there are three, four, or more apartments in the property. It is a very tricky subject as I have to deal with the practical realities of the marketplace, namely that most accessory suites are not legal, yet they continue to be rented without issue or trouble from the City. The fact is there is a lot of misinformation floating around out there and most landlords have been renting out “illegal” apartments for years. By and large, if a single-family has been converted to units, it is not likely that all the suites will meet the eligibility requirements to be completely legal – especially if it doesn’t meet the parking specifications. If a property was originally “purpose-built” as a duplex, triplex or fourplex, then the suites are usually all legal. That is why you will often see Sellers and their agents make no warranties or representations with respect to the zoning, use or legality of the self-contained units when an income property changes hands.

Most investors’ primary concern is whether you can finance and insure a property with multiple units. Whether they are “legal” or not is secondary. Remember that all suites have to meet fire code for insurance purposes. In Toronto, we have a fire retrofit standard that is used for residential accessory apartments. Bear in mind, many apartments (especially in basements) do not meet retrofit code. Also, having a retrofit certificate does not automatically make your units legal either. In a city like Toronto, where the apartment vacancy rate is low and real estate values are high, many people rely on the rental income from a basement apartment to give them the edge they need to own a home. But what is a “legal” apartment? If the suites are not “legal”, how can it be made “legal”? In the process of legalizing the apartment, will you be inviting ‘trouble’? What if the City prescribes improvements that are prohibitively expensive? What if the City decides that you can’t have an apartment? What does that mean for you and your existing tenants?

I recommend that if you are unsure about the status or “legality” of your suites or you would like to change the current status or zoning of your property that you contact the City and get further professional advice. Do not assume anything or take anything for granted. All the answers are out there – you just have to acquire the knowledge, albeit perhaps with some legal assistance. Remember that you are never exempt from building or fire codes and that you are ultimately responsible for the continued smooth operation of your investment property. If you are relying on verbal declarations from a seller or his agent with regards to legality or retrofit prior to a purchase, I suggest you wait until you have all the information you need in writing, properly verified.

Should you consider a Property Manager?

One of the first decisions you will have to make as a new landlord is how involved do you intend to be with the on-going operation of your income property if you don’t live in it. Does it make sense to hire a superintendent or property manager? You have to consider how much free time you have and whether the additional cost to hire someone is justifiable. Property managers can cost hundreds of dollars a month and sometimes that cost is the difference between an acceptable return or not. It is nice to have someone collect your rents and tend to the maintenance items but if you take care of that yourself your savings may be significant. If your property is out of town or far away then property management would make more sense. Also, if you have a lot of rental suites then hiring a property manager would be a smart move as well. The economics on a 12-plex will be more favourable to hiring a property manager then on a duplex for example. Sometimes property management companies charge a percentage of the overall gross rents. There are many options for you to explore if you decide to go down this road.