Toronto Income Property Newsletter: May 2012

The Toronto residential income property market continues to be very strong for sellers. Duplexes, triplexes and multiplexes in the east, central and west districts continue to trade for record prices. Multiple offers are still the norm and prices in excess of$50K to $100K over asking are still quite common. Returns can be negligible so buyers have to very careful to not get caught up in any silly bidding frenzies. Cap rates can be as low as 3% with many buyers taking advantage of record low interest rates and adopting a “buy and hold” strategy. Surely over time a good income-generating property will appreciate but please don’t ignore what your Year 1 spreadsheet is telling you. Remember that being landlord comes with its responsibilities, so make sure that you are being properly rewarded for it. Real estate is great, but there are lots of places to put your money, so make sure that your income property makes some sort of fiscal sense.

This month I will talk a little about the low rates and their effect on this current market. I will also show you some income properties that have traded this year to give you and idea of how things are looking in downtown Toronto.

Is the 2.99% 5 year fixed rate driving the market?

Earlier this year BMO introduced a 5 year fixed mortgage at 2.99%. The other major banks quickly followed suit in order to stay competitive. This was the lowest five year fixed rate that I have ever seen in the last decade of trading income properties. The result of this is that many buyers quickly called their lender to hold that rate (which they can do usually for 90 days) to make sure that they could take advantage before the rate went up, which it now has. The prevailing wisdom is that rates will eventually rise and in three or four years, a 3% mortgage rate will look very good. Who wouldn’t want to take advantage of the lowest five year fixed rate in history if they are in the market to buy an investment property?

The problem I feel is that many buyers may have been overpaying for their properties simply because the borrowing rate has been so favourable. If you have been using 3% as a yardstick for your mortgage costs, you might be doing yourself a disservice come year six. Let’s assume that you have a $600K mortgage and interest rates are at 5% in five years time (they could easily be higher). Your approximate payment will go from $2800 to $3500. (+ or -). That’s a $700 monthly difference if you book the same mortgage five years later. If you borrow more, your monthly increase could even be higher. The higher charge may not sink you, but consider what it might do to your income statement. Rents would have to go up quite a bit to keep pace with the proportionate increase in mortgage costs, which is not likely.

There are obviously other factors that are fueling the current hot Toronto market. The widespread availability of CMHC insurance to buyers without a 20% deposit is certainly making it easier to buy. Coupled with very low borrowing rates, it is not hard to see the increased incentive for people to get into the market. Now that the 2.99 fixed year rate has gone, let’ see if it tempers the market a little.

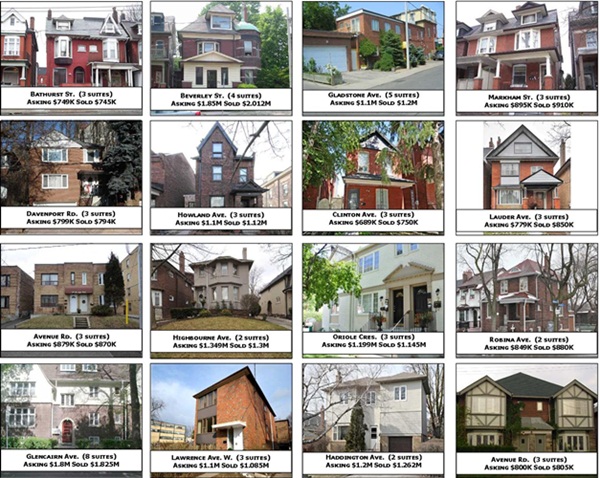

2012 Residential Income Property Sales

They say a picture is worth a thousand words. So what do the income properties actually look like that have been selling so far this year? Here are a few exterior shots of properties that have traded in 2012 in Central Toronto.

If you would like more detailed information on income property sales in your neighbourhood, please send me an e-mail.

This is the best explanation I’ve seen so far on Toronto Mortgage. Much more in depth than other post yet you’ve managed to make it really clear and concise